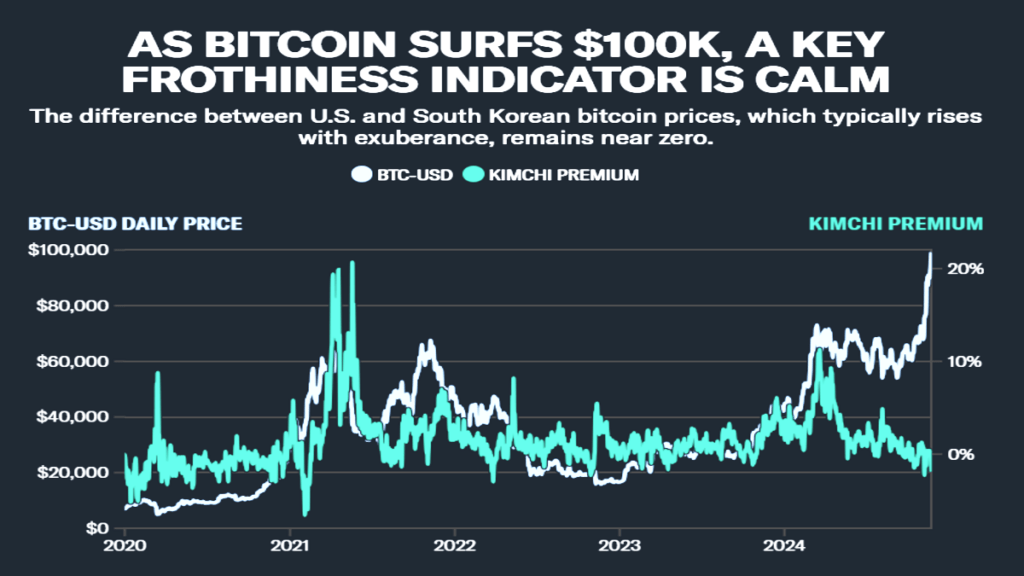

Bitcoin’s recent surge has left many investors on edge, especially those with memories of the last major rally in 2021. The cryptocurrency’s price has been climbing steadily, with some analysts drawing comparisons to previous market melt-ups. However, not everyone agrees that Bitcoin is experiencing the same “frothiness” that marked past speculative bubbles. In fact, some experts argue that the current market conditions are fundamentally different, pointing to factors like the so-called “Kimchi Premium” to explain why this rally might not be as speculative as it seems.

The Challenge of Predicting Market Movements Without Clear Fundamentals

When it comes to traditional investments, analysts can rely on a wealth of data—corporate earnings, economic growth projections, and management outlooks—to make informed predictions. This wealth of information allows strategists to base their price targets on real, quantifiable factors.

However, the world of cryptocurrency is different. With Bitcoin and other digital assets, there are few fundamentals to consider. There are no earnings reports, no executives issuing forecasts, and little in the way of traditional economic metrics to guide predictions. As a result, crypto analysts often rely on sentiment analysis to gauge the market. This reliance on sentiment means analysts must get creative, using unique indicators to determine whether a rally is driven by genuine demand or speculative frenzy.

Bitcoin’s Recent Surge: A Sign of Growing Demand?

Since the 2024 U.S. presidential election, Bitcoin has experienced an impressive rally, rising as high as $99,000—just shy of its six-figure milestone. The surge is largely attributed to growing demand, which some analysts believe is fueled by an administration that is perceived to be more crypto-friendly. With figures in power who are seen as open to supporting cryptocurrency, the market has responded positively, pushing Bitcoin to new heights.

But while the rally has been remarkable, there is a question hanging over it: Is this a repeat of previous speculative peaks, such as the one seen in 2017 or 2021? These were times when prices surged dramatically, only to crash shortly afterward, leaving many investors nursing heavy losses.

According to Sean Farrell, Head of Digital Asset Strategy at Fundstrat, there are signs that this rally is different. Farrell points out that, unlike the 2021 peak, the current Bitcoin market does not exhibit signs of “frothiness”—a term used to describe the overblown speculation that often accompanies bubbles. In fact, he suggests that the current rally is driven by a more grounded increase in demand, rather than the irrational exuberance seen in the past.

The Role of Social Sentiment: Is Bitcoin Really in the Spotlight?

One of the biggest indicators of speculative behavior in markets is social sentiment. When everyone—whether they are professional investors or casual onlookers—starts talking about an asset, it can signal that it is nearing a top. Bitcoin’s resurgence has led to renewed interest from everyday people, with many casually asking their friends and family about the cryptocurrency. This kind of conversation, while anecdotal, is often a red flag for analysts who are concerned about a market overheating.

However, Farrell cautions that while the conversation around Bitcoin is heating up, there are more quantifiable indicators to consider. The buzz on social media and in everyday conversations may signal growing interest, but it doesn’t necessarily point to the same kind of speculative behavior that preceded past bubbles.

The Kimchi Premium: A Unique Indicator of Market Sentiment

One of the more interesting tools available to crypto analysts is the “Kimchi Premium,” a term used to describe the difference in Bitcoin prices between South Korean exchanges and global exchanges like Coinbase. This premium is a reflection of South Korea’s capital control laws, which make it difficult for traders to move Bitcoin across borders. As a result, when speculation runs high in South Korea, the price of Bitcoin on local exchanges often exceeds the price on international platforms.

Historically, the Kimchi Premium has been a reliable indicator of speculative fervor. During times of excessive demand and market hype, this premium tends to spike, signaling that traders in South Korea are willing to pay more for Bitcoin due to the tight market conditions. In the past, a large Kimchi Premium was often a sign that the market was overheated and due for a correction.

However, as of now, the Kimchi Premium is close to 0%. This suggests that there is not currently a significant amount of speculative excitement in South Korea’s crypto market. According to Farrell, the absence of a premium indicates that Korean traders are not acting on irrational exuberance, and the current demand for Bitcoin is more stable and grounded.

I don't know but this time it could be like December 2020

If you see in 2020 BTC broke the previous ATH in December and the dominance started to drop at the end of December

This year BTC broke the 2021 ATH officially in November and now we are at the end of November and the… pic.twitter.com/Pm913szqQh

— PaoloG.mtrg ⚡️🇮🇹 (@Paul250889) November 23, 2024What Does This All Mean for the Future of Bitcoin?

While it’s tempting to draw parallels between the current Bitcoin rally and previous speculative bubbles, the available data suggests that this time may be different. The lack of a significant Kimchi Premium, combined with the more measured growth of demand, points to a market that is not yet in the throes of a speculative frenzy.

That said, the volatility of Bitcoin and other cryptocurrencies remains a constant reminder that the market can turn on a dime. As always, investors need to be cautious and aware of the risks involved. While the current rally may not show the same signs of frothiness as previous ones, the future of Bitcoin—like all digital assets—is inherently uncertain.

Read More : Trump’s Hush Money Sentencing Delayed Indefinitely: Judge Grants Request for Motion to Dismiss